PayLucky was an online payment solution that provided services to licensed betting sites in the USA. PayLucky betting services included handling debit and credit card deposits, processing ACH transfers, managing prepaid debit cards, paying out withdrawals and running e-wallets that players used to manage their online betting accounts.

However, PayLucky is no longer a consumer-facing brand, and its parent company, Fiserv, now offers business-to-business services to online sportsbooks under the “Carat” brand.

PayLucky served a number of licensed betting sites in New Jersey but was not specifically named as a deposit method. Instead, PayLucky provided backend services assisting operators in managing payments and withdrawals.

How PayLucky Worked

PayLucky was primarily offered as a solution to players who experienced declined credit card deposits as a result of outdated anti-gambling policies maintained by their banks.

If you had problems depositing with a credit or debit card, you may have seen the option to select PayLucky as your deposit method within your betting site’s cashier to fund your gaming account using the same card that was previously rejected.

Some betting sites also accepted PayLucky e-wallet deposits, but most online sportsbooks used it as an instant deposit method that routed your credit or debit card payment to PayLucky before crediting your online betting account. It all happened instantly, so it felt like a normal card deposit but with a much higher acceptance rate.

All in all, PayLucky was a hassle-free deposit method that worked well for people experiencing declined deposits.

More About PayLucky

PayLucky was launched as the online and land-based gambling arm of global payment services company First Data (now Fiserv) back in 2014. BetAmerica signed on with PayLucky in 2016.

Fiserv is involved in a wide range of payment operations that include providing merchant services to more than six million businesses and processing some 2,500 financial transactions per second.

To offer some perspective on the size of this company, it has been estimated in the past that Fiserv handles as much as 45% of all credit and debit card transactions in the United States. PayLucky was just one small part of an absolute behemoth of a financial services firm.

Neither First Data nor PayLucky had a whole lot of name recognition among society at large. Both companies operated primarily on the backend as service providers to other companies.

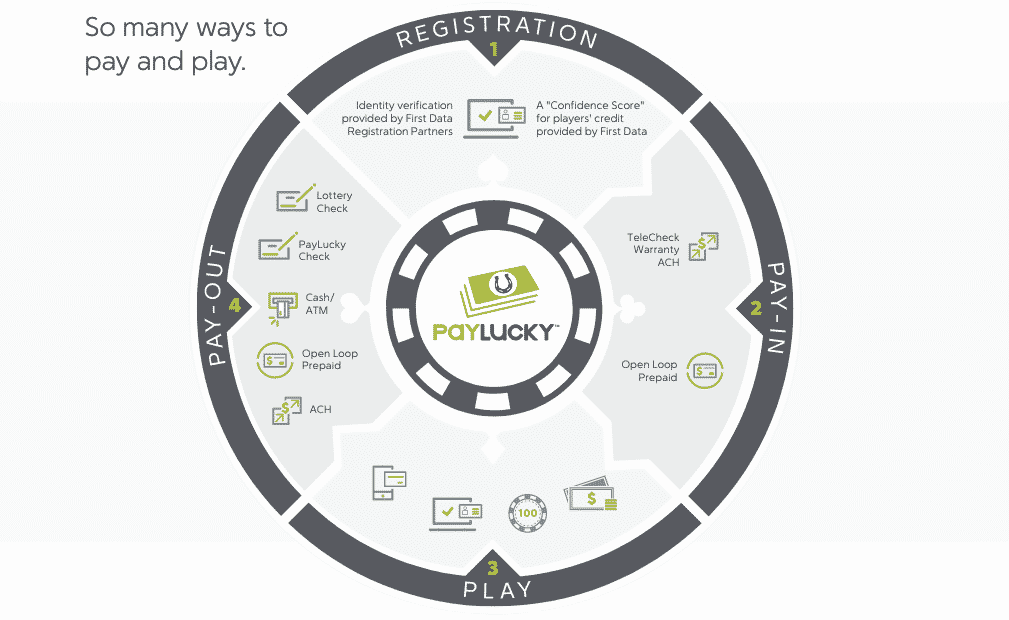

The Carat division of Fiserv provides a number of different services for legal betting sites in the US. This graphic from the Fiserv website shows, in a nutshell, how PayLucky served the online gaming industry from initial registration to payout: