Is FanDuel Sportsbook Market Share Sustainable?

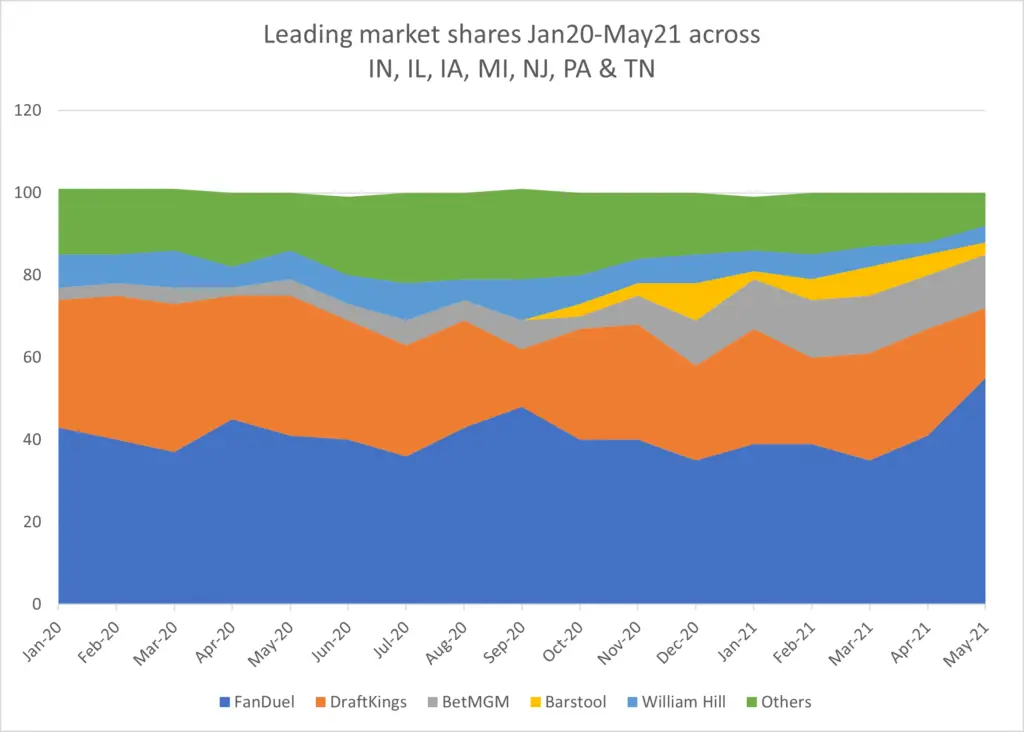

It’s hardly news to say that FanDuel Sportsbook is doing well in the US market. Just how well is displayed on page 19 of Deutsche Bank’s iGaming Monthly roundup for June of recent gross gaming revenue (GGR) reports from a basket of regulated states.

According to the chart, when looking at mobile GGR across Indiana, Illinois, Iowa, Michigan, New Jersey, Pennsylvania, and Tennessee, FanDuel’s share rose to a simply massive 55% in May, up from 41% the previous month.

Source: Deutsche Bank, state gaming commissions

In fact, over the past 17 months, FanDuel’s percentage of GGR across all these states has never dropped below 35%, averaging 41%. Its primary rival, DraftKings Sportsbook, has averaged 26.9% over the same period but fell in May to 17%.

State-by-State Analysis

Delving into each state in turn, Deutsche Bank shows that in the last 12 months, FanDuel market share is lowest in Iowa, where it has a 15% market share. However, in May that figure stood at 31%.

The same pattern shows up in more populous states. In New Jersey, for instance, the bellwether for the still-nascent sector, FanDuel’s last 12 months percent stood at 52% compared to its May figure of 62%. In Michigan, meanwhile, the LTM figure is 26% compared to May’s 48%.

In fact, in all seven states, FanDuel’s May percentage is about the LTM average, while in all but one (Iowa), DraftKings is showing the opposite trend. DraftKings’ market share in Michigan, for instance, fell to 10% in May compared to 15% LTM, and in New Jersey, it dropped from 23% LTM to 20% in May.

FanDuel Market Share Sustainability

The questions around paying much attention to FanDuel market share right now are multiple.

First, most obviously, and as every executive across the sector will tell you, we are in the first innings of the US sports betting sector. Moreover, GGR isn’t NGR, and in many states, the distorting factor of bonusing means operators can literally buy market share.

While GGR is at least a more genuine measure of performance than the share of handle, it should also be said that fluctuations on a month-on-month basis can also be seriously questioned, particularly given the seasonality of the US sport betting calendar.

But this still leaves us trying to explain why FanDuel has been so consistently holding on to a market share that would be unheard of in practically any other regulated jurisdiction, and certainly in one where the competition is so intense.

One element discussed at length previously is that Flutter and DraftKings started sports-betting operations with the considerable advantage of an extensive existing DFS player database.

This is where Flutter’s experience with multiple brands comes into play. This isn’t the company’s first rodeo, says Simon French, an analyst with leisure and gaming consultancy .

“It clearly makes sense to have bought a DFS business first,” he adds. “It looks like they have been mining a particularly good seam. Clearly, they have strong tech, a good brand, and from this distance, it looks like they have been able to focus on the basics. That’s been honed over a number of years.”

Accumulators

“Their expertise has been honed over a number of years,” he points out. “They have been able to draw on a number of separate businesses that have been rolled up into Flutter. They have that accumulated knowledge, and they can poach the best bits.”

Part of that experience comes from Australia, where Flutter runs the market-leading Sportsbet brand, which (under somewhat restricted circumstances when it comes to in-play) has a similarly dominant market share of circa 40% or more.

Lee Richardson, a consultant with , suggests that such dominance is unusual. “Markets do tend to settle down over time, and individual market shares can wax and wane, over time, for a whole variety of reasons,” he adds.

What is also intriguing about the online betting market in the USA right now is that it is increasingly becoming a market of haves and have nots. As detailed by Deutsche Bank, the percentage of the market claimed by others has also declined over the 17 months, from a peak of 22% in July last year to the low teens in recent months.

In fact, the percentage of GGR share from other operators varies widely between the seven states, from 35% over the last 12 months in Pennsylvania down to 5% in New Jersey.

As Richardson suggests, “that sort of ratio does make it appear very tough for the other, smaller operators yet to make significant inroads in a post-PASPA sports betting environment.”

Scott Longley has been a journalist since the early noughties covering personal finance, sport and the gambling industry. He has worked for a number of publications including Investor’s Week, Bloomberg Money, Football First, EGR and GamblingCompliance.com. He now writes for online and print titles across a wide range of sectors.