Sports Betting Is Booming Since The Start Of The NFL Season

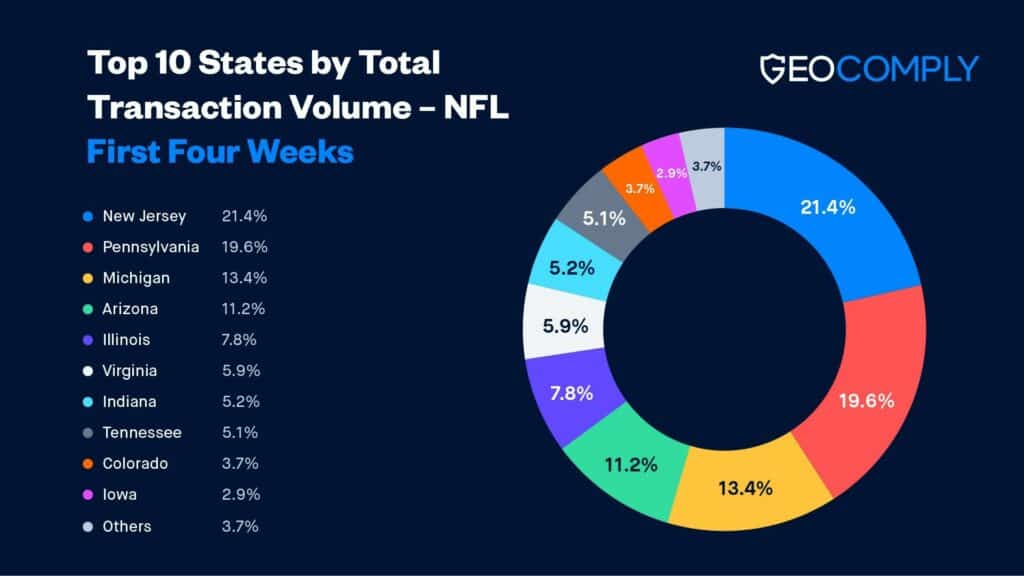

According to GeoComply, the company logged 330 million geolocation transactions during the first four weeks of the NFL betting season. That represents a 122% increase compared to the first four weeks of the 2020 NFL season when GeoComply processed 149 million transactions.

The NFL causing a spike in sports betting volume is about as surprising as the sun rising and setting every day. A (AGA) concluded that 45.2 million Americans (18% of the population) plan to wager on the 2021 NFL season.

That said, driving the boom is the increased number of legal sports betting states and the continued maturation of the industry, which includes increased customer awareness and more players migrating to legal sports betting options and away from offshore markets.

Top Sports Betting States

According to GeoComply, the five largest online sports betting markets by geolocation volume are:

- New Jersey Sports Betting

- Pennsylvania Sports Betting

- Michigan Sports Betting

- Arizona Sports Betting

- Illinois Sports Betting

“We’re excited to see the growth of sports betting transactions has carried over to the first four weeks of the season,” says Lindsay Slader, Managing Director of Gaming at GeoComply. “The data also confirms the first week in Arizona was not just a one-off, but that the state has solidified its place as the fourth largest sports betting market in the U.S. With more states poised to come online in the coming weeks and months, we expect growth will continue to accelerate through 2021 and 2022.”

The Top 10 states can be seen in the chart below, courtesy of GeoComply.

Sports Betting Is Benefitting from a Marketing Boom

The AGA data referenced above provides another insight into the current US sports betting landscape. According to the survey results, every facet of the sports betting industry will see an uptick in usage, from casual betting to online betting to illegal betting.

- 21.7 million American adults will bet on the 2021 NFL season casually with friends, up 31 percent from 2020.

- 19.5 million will place a bet online (legal and illegal), up 73 percent from 2020.

- 14.6 million will participate in a paid fantasy contest or other type of pool competition, up 69 percent from 2021.

- 10.5 million will place a bet at a physical casino sportsbook, up 58 percent from 2020.

- 6.7 million will place a bet with a bookie, up 13 percent from 2020.

The AGA survey data flies in the face of the industry narrative told in statehouses. The industry is telling lawmakers that legalized betting will cut into and eventually stamp out the illegal market. While this may be true (to some degree) in the long-term, in the short term, legalization has been a blessing in disguise for the offshore market and illegal bookmakers.

As David Henwood of explained way back in 2019, this increase is not unexpected, even as legal options are made available.

The reason is two-fold.

First, converting existing black market bettors is a slow process that will take time – ten years in Henwood’s estimations. During the 2019 ICE North America in Boston, MA, Henwood estimated that in 2019 only about 4% of offshore bettors had switched to legal betting sites

Second, the sports betting media blitz, and the offshore market’s ability to conflate legal and licensed in the US and legal and licensed in some other jurisdiction but serving the US market, has led to a confusing landscape that would-be bettors must navigate.

The combination of these two factors helps make sense of the AGA data showing increases across the board.